deferred sales trust fees

By using Section 453 of the Internal Revenue Code which pertains to installment sales and related tax provisions it lets people sell a. Wilmington Trust is a registered service mark used in connection with various fiduciary and non-fiduciary services offered by certain subsidiaries of MT Bank Corporation including but not.

Deferred Sales Trust Capital Gains Tax Deferral

Capital gains refer to the profit you made off your.

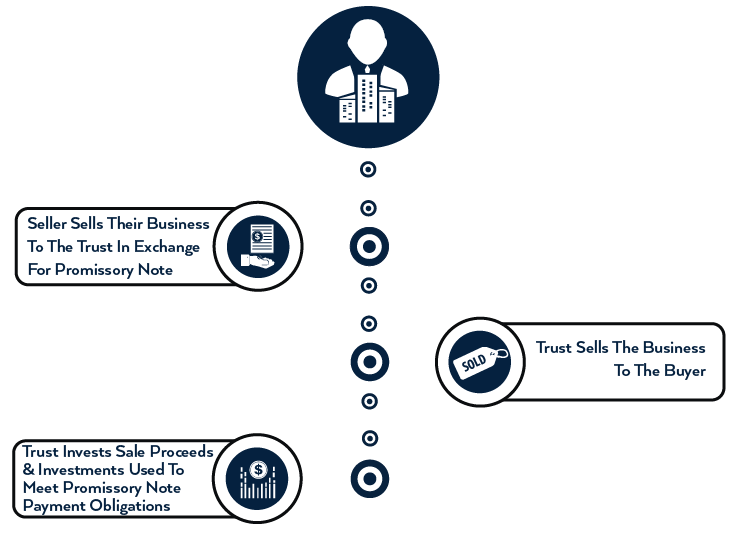

. The deferred sales trust DST is an established legal and proven tax-deferral strategy that can help you save thousands of dollars on the sale of your business practice or property. Case 1 A married couple ready for retirement plans to sell their 1 million asset and will owe 250000 in capital gains tax. Rather than a typical transaction where the seller would receive funds.

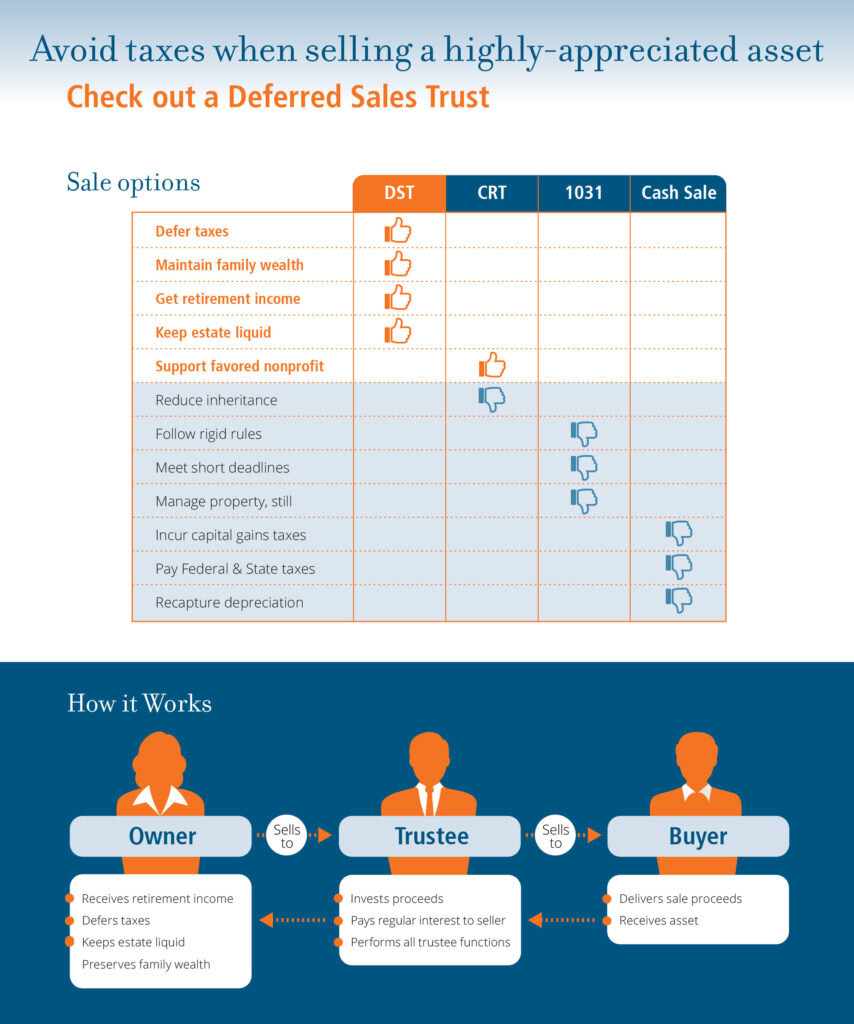

So doing a DST. The remaining funds will be reinvested to provide a consistent. Pros of Deferred Sales Trust Tax Deferral Investors are able to defer the payment of capital gains taxes until a later date or when they receive principal payment.

A family-owned trust and fiduciary company. I want you to better understand how you can benefit from a deferred sales trust so you can make more money when you sell and have more freedom with your time. New York State Deferred Compensation.

A filing fee is also. A Zoom invite will be emailed with a conference call. The security and exchange commission sec does not put a limit on what sales load funds can charge but the financial industry regulatory authority finra does.

A real property transfer formRP-5217 RP-5217-NYC or RP-5217-PDF pilot projectis required for all real property transfers where a deed is filed. I want you to. Welcome to my scheduling page.

Thats where the Deferred Sales Trust comes in. Based on a sliding scale with maximum fee of 15 of trust amount. The deferred sales trust DST is a legal time-tested investment strategy to defer capital gains tax on the sale of your business or property.

Please follow the instructions to add an event to my calendar. Assume that the sellertaxpayer wanted to invest his or her money so. Based in Switzerland and Luxembourg we provide specialised services.

Control of Funds At the close of escrow funds are transferred by escrow into the custody of a DACA account or a. One investment says If I understood you properly you make the transaction you defer 26 million in taxes youre left with 6 million. A deferred sales trust DST allows for the deferral of capital gains tax when selling real estate or other qualified assets.

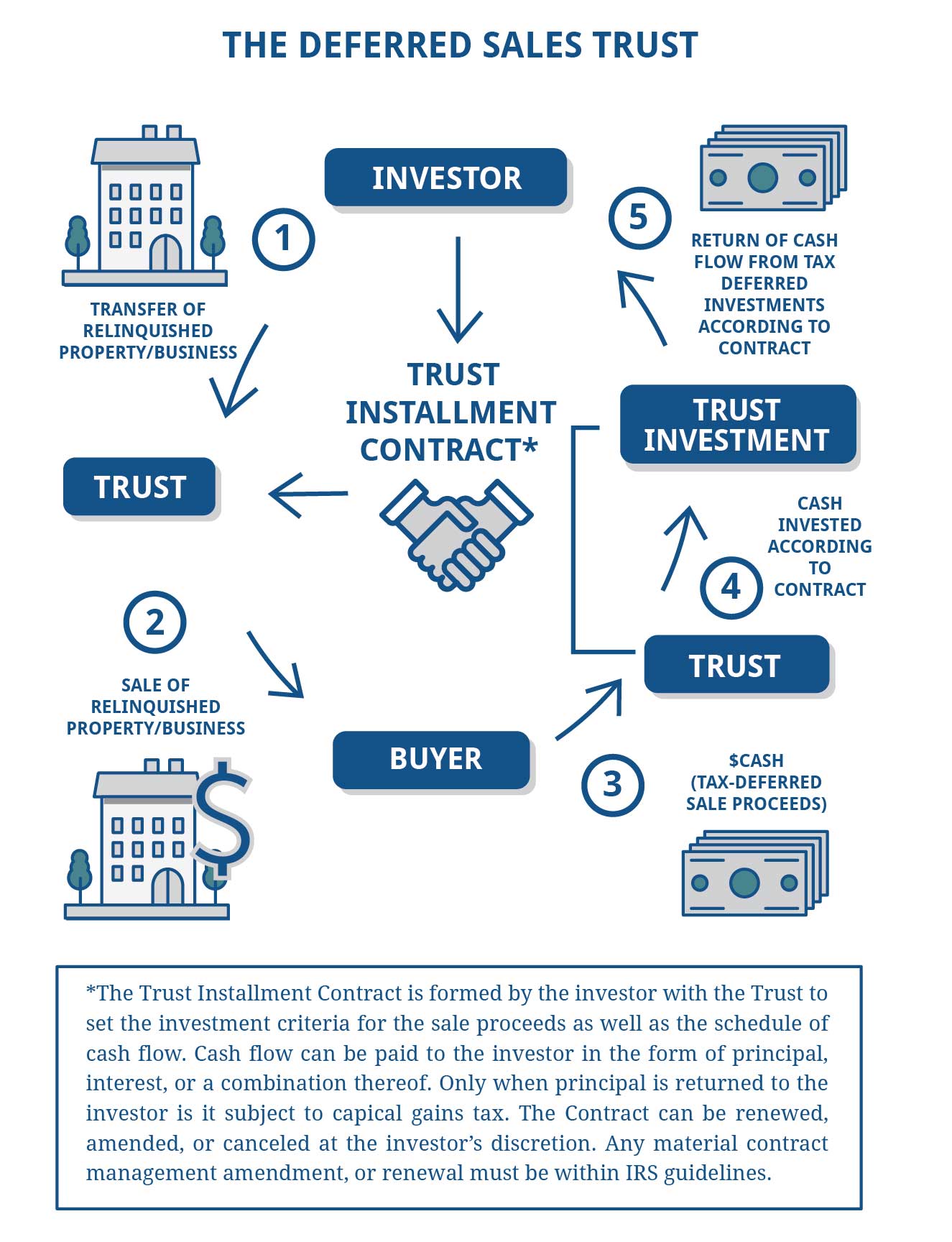

BiggerPockets Real Estate Podcast BiggerPockets Money Podcast BiggerPockets Business Podcast Real Estate Rookie Podcast Daily Podcast Audio Blog. DEFERRED SALES TRUST PROCESS ASSETS TO SELL CLIENTS CASH BUYER Sells to a third party trustee in consideration of a secured DST installment contract Sells Assets to Cash Buyer. To families companies and charitable organisations.

Then I say Well what are 26 million in. The legal and setup fees for establishing the Deferred Sales Trust would be approximately 15000.

Is The Legal Fee For The Deferred Sales Trust Worth It

Deferred Sales Trust Legacy Tax Strategies

Capital Gains Tax And Deferred Sales Trusts Ameriestate

![]()

Capital Gains Tax Solutions Using Deferred Sales Trust Strategies Investthis Podcasts On Audible Audible Com

Deferred Sales Trust Legacy Legal

Capital Gains Tax Solutions Using Deferred Sales Trust Strategies Investthis Podcasts On Audible Audible Com

Deferred Sales Trust O Connell Investment And Insurance Services

Deferred Sales Trust Oklahoma Bar Association

Pros And Cons Of The Deferred Sales Trust Reef Point Llc

Capital Gains Tax Rates Capital Gains Tax Solutions

Ep Nna 60 Why You Should Consider A Deferred Sales Trust With Brett Swarts We Close Notes

Selling My Business Capital Gains Tax Business Sale

Deferred Sales Trusts How Do They Work Cohan Pllc

Deferred Sales Trust Www Touchpointbusinessedge Com

The Ultimate Insider S Guide To The Deferreed Sales Trust

Deferred Sales Trust Made Simple Is The Deferred Sales Trust Legal Youtube

The Deferred Sales Trust A Solution For Many

Deferred Sales Trust Capital Gains Tax Deferral

8 Deferred Sales Trust Ideas Trust Capital Gains Tax Capital Gain